Premium starting

at Just ₹2094*

9000+ Cashless

Garagesˇ

Over Night

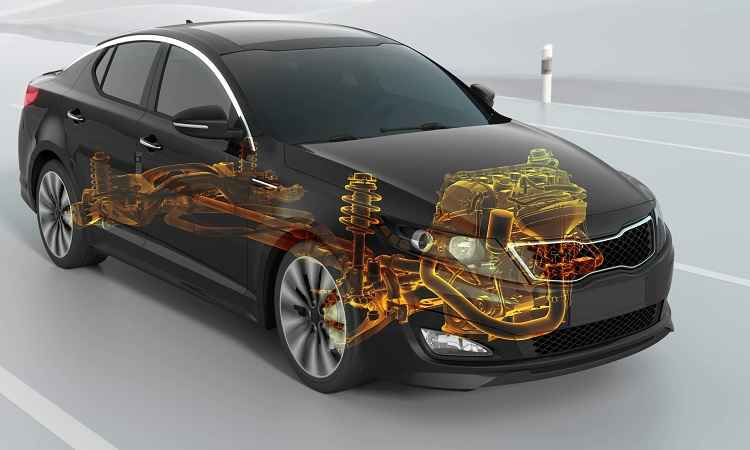

Vehicle Repairs¯Engine Protection Cover In Car Insurance

An engine protection cover in car insurance is an additional cover that provides enhanced protection to the engine against damages not covered in a standard comprehensive car insurance policy. It provides coverage for losses caused due to waterlogging, oil leakage, and damages to the engine parts like the gearbox and cylinder.

Having an engine protection cover becomes essential especially in monsoons as cars are prone to engine damage caused by water seepage. It reduces the high cost of repair and maintenance of the engine, hence offering peace of mind to the vehicle owner. It is generally advisable for new or high-end car models.

Benefits of Purchasing Engine Protect Add On Cover

Listed below are the benefits of purchasing engine protection add-on cover.

Financial protection

Covers water damage

Covers oil leakage

Higher resale value

Hassle-free claims

Increased lifespan

No depreciation

Car Insurance Coverage

A regular motor insurance policy does not cover damages to the engine, the engine protect add-on provides broader protection to ensure the longevity and optimum performance of your car's engine.

Damage Due to Flood

Damage Due to Leakage of Oil

Accidental Damage

Damage Due to Unforeseen Events

Damage to Engine Components

Gearbox Components

Labour Cost For Engine Repair

Machining Operations

This add-on cover proves highly beneficial, especially for those who live in areas prone to waterlogging, and for cars that have high-end engines or for those whose engine and spare parts are expensive.

How Does Engine Protection Cover In Car Insurance Work?

The engine protection cover in car insurance provides financial protection for the damages to the engine and its parts. This may include the gearbox, engine parts, cylinder, piston, pins, and more, depending on your policy. Here's how it works.

Protection from

high repair costs

Covers more than

just collision damage

Range of

components covered

Small premium,

large coverage

Useful in high-risk areas

Limit on number of claims

Who Should Opt For an Engine Protection Cover In Car Insurance?

Those who should opt for an engine protection cover in car insurance include individuals who live in areas prone to flooding or water-logging, people with high-end or luxury cars with expensive engines, and those who frequently drive long distances. Individuals with newer cars might also want this additional cover for added security. Additionally, individuals whose car loans are not fully paid off might benefit from engine protection cover to ensure they won't incur extra debt if the engine is damaged.

How Can I Opt For An Engine Protection Add-On?

Purchasing an engine protection add-on will increase your premium amount. However, it will save you from major expenses that could arise from any engine-related damage. Here's what you need to know.

Identify insurance provider

The first step in purchasing an engine protection add-on is to identify your vehicle insurance provider. Ensure they offer an engine protection add-on, and understand what it covers.

Research

Compare various engine protection add-ons provided by different insurance companies. Look into details like the extent of coverage, cost, terms and conditions, exclusions, etc. to understand what suits your requirements best.

Get a quote

After selecting the most suitable insurance provider, reach out to them to get a quote. Usually, the premium for an engine protection add-on is a certain percentage of the car's Insured Declared Value (IDV).

Contact customer service

You can call the insurance company's customer service or meet with an insurance agent for any queries or clarifications about the add-on.

Contact customer service

Please contact the insurer at their toll-free number to schedule an on-site inspection. Do not move the vehicle until the survey has been conducted.

Purchase

Once you have all your questions answered and have made your decision, you can go ahead and purchase the engine protection add-on. This could usually be done online or offline at your convenience.

How To File a Claim For Engine Protection Cover In Car Insurance?

Filing a claim for engine protection cover in your car insurance involves specific steps, including informing your insurance company, filling out a claim form, and providing necessary documents. Here's what to do.

1. Assess the damage

After noticing the engine damage, do a thorough assessment to determine whether it's indeed covered by the engine protection cover. Some of the instances covered by this insurance are damages due to leakage of lubricant/oil, water ingression, or hydrostatic lock. It could also happen that the vehicle stopped in a water-logged area which resulted in an internal damage or there is clear proof that there is an under-carriage damage to the internal parts of the engine.

2. Report the damage

Immediately report the incident to your insurer. Explain the entire scenario to them so that they can guide you with the necessary procedures for claim filing. You need to keep these 2 aspects in mind:

1. Do not try to start the vehicle once it has stopped in a water-logged area or there is damage in the undercarriage.

2. Call the toll-free number immediately for a spot survey without moving the vehicle from the place where it stopped.

3. Document the incident

Ensure that you have sufficient documentation about the damage. Take clear photographs of the damaged part and gather any other proof that supports your claim.

4. Filing the claim

Follow your insurance provider’s claim process. This generally includes filling out a claim form which should be accompanied by all the required documents.

5. Claim approval

There should be an evidence that indicates that the insured vehicle came to a halt in an area submerged in water, which led to water seeping into the engine and/or gearbox and damaging its internal components. Furthermore, there should be proof of damage to the underside of the engine and/or gearbox, causing oil to leak and consequently leading to harm to the internal parts of the engine and/or gearbox.

If your claim is justified, it will be approved and the cost of repair or replacement of the damaged parts of the engine will be paid by the insurance company.

Important Things To Know About Engine Protect Cover

Engine protect cover is an add-on feature that you can opt for when purchasing or renewing your car insurance policy. It is primarily designed to cover the costs associated with damages to your car's engine.

Comprehensive coverage

Nullify depreciation

Hydrostatic lock cover

Increases policy premium

Condition-based

HDFC ERGO Car Insurance Add-ons

In addition to Engine Protect Cover, you should also consider adding the below mention add-on cover with your standalone own damage or comprehensive plan.

With the increase in usage of the vehicle, the wear and tear increases, thereby leading to depreciation of its parts. Since depreciation is not covered in the insurance claim, it incurs out-of-pocket expenses.

With this add-on cover, you can keep your no claim bonus intact despite making claim during the policy period. Moreover, you can also take it to the next NCB slab earning.

With roadside assistance cover also known as emergency assistance you will get round-the-clock assistance to deal with any mechanical breakdown issues of your vehicle.

Cost of Consumables

This add on cover with standalone or comprehensive cover provides coverage for consumables items like lubricants, engine oil, brake oil, etc.

With tyre secure cover, the insurer will bear expenses related to replacing the tyres and tubes of the insured vehicle. The coverage is offered when the insured vehicle’s tyre burst, bulge, puncture, or face a cut during an accident.

Unfortunately if your car suffers irreparable due to any unforeseen events or it cannot be traced in case of a theft. At that time, the return to invoice add-on cover will help you get the invoice value of that vehicle.

Engine and Gear Box Protection

The engine is the heart of your car, and it is crucial to ensure it is protected. This cover shields you from the financial losses incurred due to damage to your car engine.

If your car is in the garage for repair purpose, this add on cover will help you get expenses for commutation during that period.

Loss of Personal Belonging

This add on covers the loss of your belongings such as clothes, laptops, mobile, and vehicle documents like registration certificates, etc.

With pay as you drive add-on cover, you can get the benefit during renewal of own-damage insurance. Under this cover, you can claim benefits up to 25% of the basic own-damage premium at the end of policy tenure if you drive less than 10,000km.

Car Engine Maintenance Tips

Replace the engine oil Regularly

Flush the cooling system

Check for oil leaks

Replace the fuel filter

Change the wires and spark plugs occasionally

Health Insurance

Health Insurance  Travel Insurance

Travel Insurance  Car Insurance

Car Insurance  Cyber Insurance

Cyber Insurance  Critical Illness Insurance

Critical Illness Insurance

Pet Insurance

Pet Insurance

Bike/Two Wheeler Insurance

Bike/Two Wheeler Insurance  Home Insurance

Home Insurance  Third Party Vehicle Ins.

Third Party Vehicle Ins.  Tractor Insurance

Tractor Insurance  Goods Carrying Vehicle Ins.

Goods Carrying Vehicle Ins.  Passenger Carrying Vehicle Ins.

Passenger Carrying Vehicle Ins.  Compulsory Personal Accident Insurance

Compulsory Personal Accident Insurance  Travel Insurance

Travel Insurance  Rural

Rural